I’d say that’s not really a flaw in Medicare. My brother is in Colorado and a gal who is under 65 had an accident in Durango was flown to Denver at a cost of $94,000. Does your insurance cover air ambulance?

Nobody said it was a flaw in Medicare. Rather, the patient opted to not purchase Part B. Her family is now dealing with the consequences of that decision.

How can the daughter be on the hook for her mothers debt, except that Medicare will be paid out of her mothers assets before the daughter gets her inheritance.

From the article:

That meant when the bill arrived less than two weeks after her death, her estate was expected to pay the full air-ambulance fee of nearly $82,000. The main assets are 12 acres of land and her home in Decherd, Tennessee, where she lived for 48 years and raised two children. The bill for a single helicopter ride could eat up roughly a third of the estate’s value, said Wieberg, who is executor.

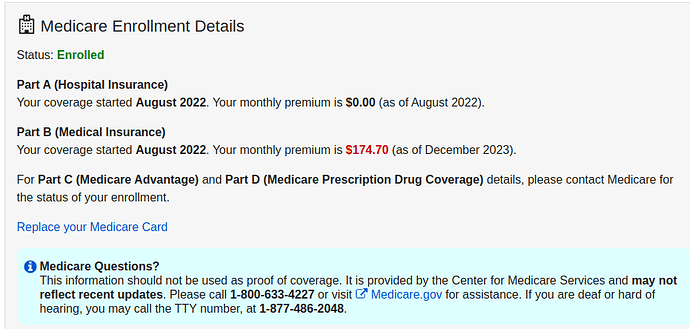

Yep. If she paid the $175 a month for Part B her bill would have been under $2,000 or less. NPR had a story on it this morning, the daughter complained about it costing her $80k from her inheritance.

That’s what the daughter is complaining about, her inheritance will be $80k less because of the helicopter bill. I don’t see the problem, the mother chose not to get Part B.

I wonder if she had a job where the employer paid the bulk of her insurance and thought that $175 was too much. A lot of people have no idea how much insurance costs. When I retired at 60, the state law required that I be offered my previous health insurance (not subsidized). IT cost me $800 per month. When I was working my share was about $50 per month. I suppose someone might think it was just $50 but they didn’t use it that much and $175 was too much. It was a helluva savings for me.

I took Social Security at 62 so I was automatically enrolled in Part B. This woman was 70…I wonder if she was on Social Security or if she was delaying it to maximize her benefit.

I thought Part B has to do with Medicare at age 65, not social security.

I was always under the impression that most of a persons debt died with them. My father got a few bills after he passed, i wrote ‘deceased’ on the bill and i got some consolation letters in the mail. Even state taxes, the lady from Georgia DOR called to express sympathies.

If you are on social security, when you are able to go on Medicare, you are automatically enrolled and the amount is deducted from your Social Security Check. If you have been on Social Security for at least 4 months before you turn 65, it’s automatic and you have to opt out. If you aren’t on social security, when you sign up for Medicare you have to specify if you want part B or not. If you are on Medicare before you claim Social Security in order to maximize your benefit, you will not be automatically enrolled in part B when you finally take social security. IF you ever log into your social security account, you will see lots of Medicare information.

Ah, I get it. I thought you meant you were enrolled in Part B at age 62.

NOpe. Took social security at 62 and have zero regrets.

The deceased’s bills will be paid out of the estate. If the liabilities are more than the assets those owed are out of luck.

My younger sister lived fast and fancy. Drove a $90,000 Mercedes convertable (in 2008). When she passed away, she had lots of debt but no will. She bought the Mercedes with money she got from our mom’s estate. She had one son and my older sister said that we should try to get the car for him. I had a buddy who was a lawyer down there and asked him about that. IT wasn’t his area of expertise but he relayed it to an estate attorney. He called back and said his freind said “intestate with loads of debt? I wouldn’t get near that with a ten foot pole”. YOu can’t pick and choose. If someone said they wanted the car, then they pretty much said that they wanted all the debt as well.

Nope, the estate becomes liable for the decedent’s debts. It was likely those were small debts and the creditor deemed it unnecessary or inefficient to pursue the amounts. If the debts had been sizeable, the creditors would have likely taken some action to collect.

My FIL had an insolvent estate, being unable to pay about 70% of the debts. My wife handled the probate and determined that she would pay out the same percentage to all creditors after the funeral expenses had been been paid. ATT was the only creditor who objected. She told them the plan had been filed with the court and they had 30 days to contest the plan in court. Never heard another word.

This topic was automatically closed 7 days after the last reply. New replies are no longer allowed.