they halt stocks all the time. There are rules behind it. Once they hit a certain threshold, they stop trading.

Andreas Antonopoulos is one of the crypto enthusiasts I used to follow.

Before he got into the crypto space, he worked in a big Wall St firm. He says movies like The Wolf of Wall St depict the common personality type perfectly: arrogance, narcissism, sociopathy, etc.

They do not give a flying crap about the citizens. They don’t concern themselves with following laws or regulations. They know any fine they’d face is a pittance, and they merely incorporate it into the cost of doing business.

All these rules that supposedly govern Wall St, in practice govern ordinary citizens without millions of dollars to their name for lawyers on retainer. The Wall St slickers, however, know the rules & the enforcers, and they are not one bit intimidated.

Fallacy of authoritarianism & excessive rules.

Only fools want more regulation. This is what regulation looks like. Empowers & aids the very people it is supposedly intended to control.

Description at the link

I lost a ton of money yesterday (on paper) and my son made $4000! I just hope he doesn’t think this is an average Tuesday and the money will always come this easy.

Reminds me of when my son turned 18 and bought $20 of scratch off lottery tickets. He won $2 and felt stupid, worst thing that could’ve happened is he wins $500 and develops a gambling problem.

I use M1. AMC Is a stock I held. I sold some of it yesterday.

I have a diversity of stocks I own and AMC is one because I like going to the movies. Funny they’re doing this to AMC

It is a fascinating theory.

They are using the group as a mini hedge fund.

One could argue what they’re doing is illegal but then I think you could say the same of a hedge fund.

If anyone is interested in options

The Options Industry Council (OIC) - Home (optionseducation.org)

Now they’re blaming the alt-right for this. How funny.

I understand what has happened to GameStop prices and those who shorted it. But, at some point, those paying $400+ are going to lose their shirts (it opened at $468 today is now $370). The price will come down, and it may have begun.

I am still working through it. The claim is no, they won’t but the hedge funds will.

From my understanding what they are trying to do is bring it back down slowly so the only people to lose big money are the ones that shorted it in the beginning.

Warren proved the broken clock theory again.

AOC said something too, but I am pretty sure she doesn’t understand any of this.

If you got in on the jump early, you probably could have sold those shares for a big gain as the funds had to cover their shorts. But, if you bought yesterday or the day before, you’d have a problem. The stock is now about $232, down 50% for the day

You are looking at this as a Capitalist.

From my understanding (not an expert on Reddit trading boards), this wasn’t done to make money, but to punish the hedge funds that were already treating Wall Street like a casino.

I yam what I yam, and that’s all that I yam.

Going a little into the weeds here, but while I am a Capitalist, I am not against collective behavior, as long as it is voluntary.

I spent several years as a union officer, including a year as Chief Stewart and a year a President.

Nobody is forcing the “Wall Street Bets” crowd to put their money in, and it appears they know what the hell they are doing, so more power to them.

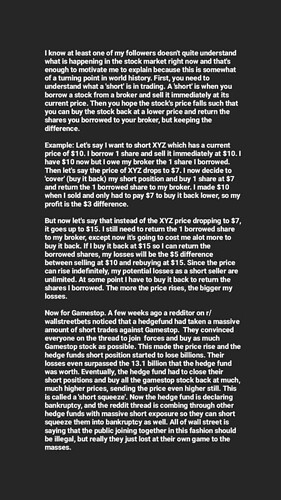

MC, I think that’s a fair explanation. I don’t sell short, but there is a lot of money to be made or lost doing it (I’d say more lost than made, but you pay your money and take your chances). Short squeezes do happen without the Reddit involvement when prices move opposite the short. Redditors (and others) recognized that there were more Game Stop shares shorted than outstanding shares (I think it was 1.4x) and recognized that moving the stock price up through purchases would do two things - require the funds to pay them a lot more for their shares to cover the short sale when the date to cover was close, and hurt the finds badly by draining them of money and other investments (which was the primary reason).